Introduction

The ACA Forms Approval section includes options to preview the forms before they are approved. Previewing the forms is one of the most important steps of the ACA process. It is important to preview the forms before clicking to "Approve Forms" them. Fixing a form error is easier to do before they are approved. Once you click approve, the forms are immediately sent to a queue to be printed. Once you click "Approve Forms," if you need changes made to the forms, there may be additional fees incurred.

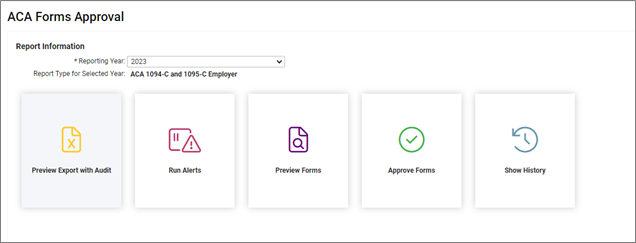

ACA Forms Approval

Navigate to Client Management > ACA Setup Options > ACA Forms Approval. The ACA Forms Approval screen displays options that allow you to perform different functions. These items include Preview Export with Audit, Run Alerts, Preview Forms, Approve Forms, and Show History.

Preview Export with Audit

This provides an excel condensed version of the ACA Forms, and highlights issues that should be addressed prior to approving forms. Yellow highlights possible issues, these should be checked and fixed if needed. Red highlights errors that should be corrected prior to form approval. Tabs in excel also list out the Full-time Employee Counts for each month, and any employees that were not included in the Full-time Employee Count. Once you click to run the report appears in the My Reports Queue.

Run Alerts

Run Alerts produces a condensed version of the forms and highlights issues that should be addressed prior to approving the forms in PDF version. The report only shows the items that the system is pulling or calculating, and excludes the normal form layout so it has condensed information making it easier to preview what populates on the forms. Once run, the report appears in the My Reports Queue.

· Items highlighted in red are critical issues and cause the file to fail when submitted to the IRS.

· Items highlighted in yellow are warnings which should be corrected but won't prevent the file from sending.

· The first page reflects what populates on the 1094 (aka the customer cover page for the IRS).

This image gives an example of an error that must be corrected:

· The ensuing pages include the employee data as it populates on the forms based on the current setup.

o The image below shows employee data that pulls and a few examples of things to look for.

o The data that populates is based on what data is set up within the system and is custom for this particular customer.

o The yellow highlight shows an employee SSN that the system knows is not real and should be corrected.

o When reviewing the data, you may find it helpful to look at the hire and term dates first. You would then have an idea what codes you may see for particular months.

o Keep in mind, Line 14 does not reflect if they had coverage. Rather, it reflects if they had an offer of coverage.

o You may find it helpful to have the ACA Codes Cheat Sheet open while reviewing the data. You may want to flag this as a favorite, so it is added to your University Dashboard for future reference. Doing this ensures that you are always viewing the most recent version of this article.

· Review the data for incorrect information and make corrections as needed.

· Re-Preview to be sure everything is now pulling correctly, repeat if needed until all is correct. This must be done for each legal company.

· The last page includes an Error Count for Potential & Critical Errors in case you missed it in the previous pages.

Preview Forms

This card when selected produces a full version of the 1094 and 1095 form, it does not highlight known issues. The first three pages are the 1094 (aka client cover page for the IRS) which includes the company data. The remaining pages are the 1095 forms which include the employee data. These are what will be filed to the IRS so accuracy is paramount. Forms are placed in the My Reports Queue.

· Review the forms for incorrect information.

· Make corrections as needed inside of isolved.

· Re-Preview to be sure everything is now pulling correctly, repeat if needed until all is correct.

· This must be done for each legal company that is filing.

Approve Forms:

Only after you have thoroughly reviewed the forms via the Preview Forms, Preview Export with Audit and/or Run Alerts, and you check off that you certify and confirm that all data is correct on the forms and that you have used the audit utilities, you can then select to "Approve Forms."

· Once you select Approve Forms, the system commits the forms to the Year End Batch Print for printing and filing.

· Don't select Approve Forms prior to 1/1 of the next year to avoid any possible changes to employee data that may impact the forms.

· If you discover an error after selecting "Approve Forms", you must contact your Support team to:

o Have them unapproved the forms.

o Provide details to them if you would like all the forms reprinted, just a particular form reprinted or don't reprint.

§ The employee sees the updated form in ESS once they are posted here.

§ If having forms reprinted, you may be charged again for the printing and shipping.

o The User data that approved and the Approved date populates once the forms have been approved and sent to be printed and filed.

· The forms are submitted to the IRS Air system after the IRS has opened their site for submission.

Show History

This tab can be used to show the history of the forms approval, including the user ID, Begin and End date.

1094/1095 B Forms

For the 1094/1095 B forms the Preview Export with audit and the Run Alerts card is not applicable and only shows the three applicable cards for B forms. Same functionality for these cards apply to the B forms as they do to the C forms.